This section will discuss the research questions as proposed in Chapter 1. The section considers the specific questions one after the other utilising the theory from Chapter 2 as well as information collated from interviews conducted and documents in the case firm – PwCGhana. The discussions adopt the characteristics of TPM and APM and analyses the extent to which those elements exist in projects managed by the various LoS in PwC-Ghana. In the end, challenges identified under TPM would be set against APM and assessed whether APM can help solve them.

How is TPM applied in consulting firms?

Rigid and Detailed Planning

From the literature in Chapter 2, TPM was identified as an approach that is characterised by rigid and detailed planning (Shenhar, 2004). This is because there is an assumption that risks and projects’ environments are adequately predictable and can be managed through detailed planning (Weinstein, 2009). Therefore, under TPM, planning is very detailed and there are tasks that attempt to capture all elements of the project. This gives little room for changes in the plan during the execution of the project (Augustine and Woodcock, 2008) as the tasks are sequenced in a rigid way to ensure that all the risks identified are addressed accordingly and the project is delivered on time. In PwC, the assurance LoS carries out audit and assurance projects only after predicting the risks involved in the project and assessing how those risks can be mitigated. Specific steps are then enumerated to deal with each of the risks within set timelines. One of the interviewees from the assurance LoS, EF noted that

“In PwC, assignments are mainly risk-based and the risk level,… determines the experience level of team members that should be put on any project”.

CD, another interviewee from assurance adds that

“One of the key elements of every audit and non-audit assignment is risk assessment, which the Standards emphasize. … In PwC assurance, our system pulls out the risks that should be addressed after putting in some information about the client … and steps are created within the client file to address those risks”.

From these, assurance projects can be said to follow a rigid and detailed planning, which stems from the Standards that guide the planning, execution and completion of projects. There is also a lot of emphasis on predicting risks and the project environment since that is one of the factors that determine even the team’s experience mix. EF also mentioned that

“Teams follow plans as much as possible but there is some minimum flexibility in terms of details”.

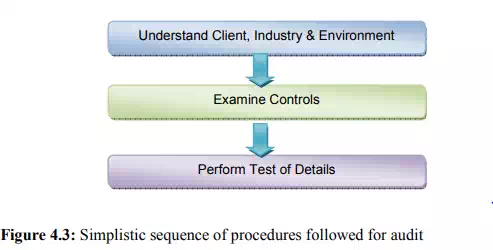

This gives an idea of the strict adherence to plans agreed at the beginning of the project. In other words, any change should go through some review and structured approach before it is accepted. There is also strict sequencing of activities and tasks in the assurance LoS, especially for audit and similar assurance assignments where a pattern is followed for every project. The pattern involves the procedures described simplistically in Figure 4.3 below.

Project planning for Tax LoS projects also involves assessment and prediction of risks. Planning of projects involves assessing risks associated mainly with the client. This is because the firm seeks to protect its reputation and brand name by trying to disassociate itself from clients involved in unacceptable business and practices. As IJ, an interviewee in the Tax LoS, identifies

“… you start with all the client acceptance procedures and making sure that you do all the due diligence on the client before you accept to engage with them”.

Having done the risk assessment and accepted the client, structured projects tend to involve a bit of detailed planning since procedures may have been tried and tested on previous projects, the risks are quite known and team members generally have experience handling such risks.

The Advisory LoS, like Tax also performs risk assessment on the client, after which some detailed planning is performed for structured projects. Planning in Advisory may take a lot more time in view of the complexities involved in understanding and meeting client needs. OP, from Advisory indicates that

“So if it is a simple assignment, you would sequence the tasks quite clearly because it sets the mind up for the client and for the team and that way you are able to minimize any surprises”

MN, from Advisory LoS, also gives another dimension of the risk assessment during planning, which involves ensuring that the project is within the expertise of PwC. He asserts that

“We are very risk sensitive and averse and these are the major drivers. We wouldn’t do or we wouldn’t want to do any job that we don’t have competences, that is our number one priority and therefore we only do jobs based on our products codes”.

It should be noted that, though Tax and Advisory adopt detailed planning for structured projects, they differ from Assurance to the extent that their teams may modify the plan and sequence of tasks as they deem appropriate. In other words, there is no rigidity in terms of the details of the plan and teams can modify through a brainstorming session without necessarily resorting to previous methodologies.

It can be inferred that though all the Lines of Service perform planning, which includes risk assessment of clients and projects, Assurance LoS goes a step further by detailing and sequencing procedures, which are rigidly followed in addressing the risks identified. Structured projects under Tax and Advisory also detail and sequence tasks but there is a lot of flexibility since the plan can be modified at any time.

Comments are closed