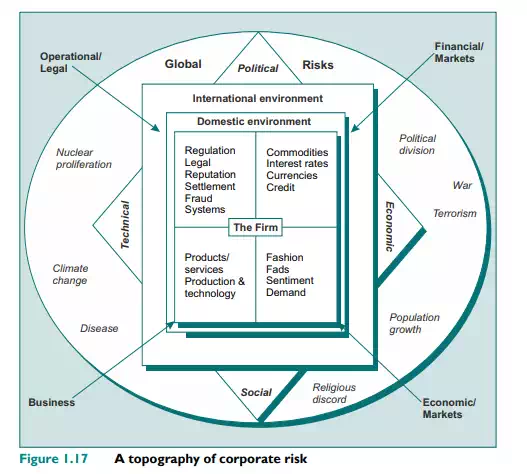

k landscape is multidimensional. Different management and administrative disciplines have to confront the problems of risk: health and safety, transportation, public policy, the environment, technology, science and many other areas are involved. There are a number of different ways of laying out the different risks facing an organisation. One such way of looking at risks is shown in Figure 1.17.* Two important conclusions can be drawn from this approach.

The first is that financial risk management is only one aspect of risk. Although this course concentrates on financial risk management, the approaches used to manage financial risk may be applied to other aspects of an organisation’s activities. The second is that, although the material covers the top right-hand quadrant, the other quadrants impact on financial risks. Ultimately, every part connects with everything else. The objective of risk management is to control risks in such a way as to allow the effective operation of the organisation within its capabilities and resource constraints.

Risk Management

Organisations have no choice in managing risks. If an organisation has a sensitivity to a particular kind of risk due to the activities it pursues, then changes in this risk factor will change the current and future cash flows of the organisation. As previously discussed, organisations have to choose what objectives to pursue in handling these exposures. The basic risk management premise is to have more of the good and less of the bad. The key management task is to balance the desirable objective of risk reduction with the costs of so doing (the cost–benefit analysis discussed earlier). We will examine why organisations manage risks and what these risks are in detail in the next module. Typically, the organisation will want to be confident that changes in the external environment do not affect its objectives. As the next section indicates, the organisation is likely to have a multiple set of objectives that it will seek to pursue in handling its various exposures.

Objectives of Risk Management

In seeking to manage risk, individuals and organisations need to define an objective or a set of objectives in deciding how and when to manage and what to do about risk. A common goal for firms is to increase shareholder value. For individuals it may be their wealth, or what economists call ‘utility’. That is, the object is to increase the value of the firm through increasing the present value of its future expected cash flows. In normal circumstances, in pursuing the goal of increased shareholder value, firms are likely to evaluate risk management decisions on the basis of two criteria: the cost of reducing risk and the cost of setting risk levels at an acceptable level – that is, in line with the particular firm’s risk appetite or risk tolerance. In essence, firms will be evaluating risk on the basis of cost–benefit criteria. The cost of risk management relates to the price to be paid for risk control, be it via insurance, management time or lost opportunities from hedging. Firms will want to economise on these incidental expenses of being in business. In doing so, firms will want to arrive at an acceptable level of exposure in order to allow managers to focus on the core activity of value creation and not be preoccupied by the nature, extent and consequences of the risks in the business to the exclusion of its value-enhancing objective.

The situation is different once a major loss has occurred. At this point, the objectives of risk management change. The overriding objective becomes survival. In such a situation, the results of excessive risk taking are likely to significantly jeopardise the firm’s survival. Firms will be looking to create a stable set of earnings and, where the loss has been a physical one, such as a fire or damage to plant and equipment, the ability to continue operations. Lastly, the firm will be concerned about its future growth prospects and development. The objectives of risk management are thus different depending on the firm’s development and recent history.

Hence, since the nature of the firm’s objectives is changed by a major loss, to the possible detriment of its fundamental objective, avoiding the loss becomes, in itself, a desirable objective.

Of course, concerns such as satisfying externally imposed obligations, for example health and safety regulations, employment law and so on, as well as meeting issues of good corporate citizenship, will be applicable both before and after any serious loss.