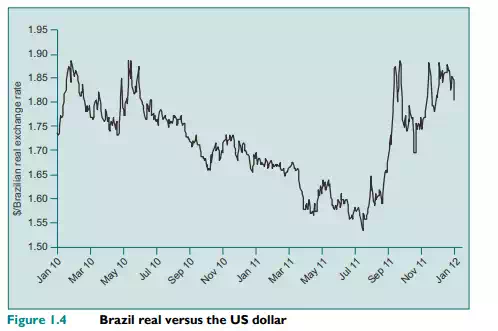

In 2011, the appreciation of the Brazilian real against foreign currencies became a huge problem for the country and its domestic firms. The rising exchange rate, which had increased by 8 per cent in the first half of the year and hit a 12-year high against the dollar at the start of July 2011, made local producers increasingly uncompetitive against Asian countries. This problem arose because countries such as China, Vietnam and the Philippines had currencies that were linked to the US dollar. As Figure 1.4 shows, the Brazilian real appreciated against the US dollar, making Asian imports correspondingly cheaper in local currency terms. This had a devastating impact on local firms, leading to President Dilma Rousseff declaring: ‘We must protect our economy, our manufacturing efforts and our jobs.’

The problem arose during the spring of 2011 because nominal interest rates in Brazil were significantly higher than elsewhere in the world, and hence foreign capital flooded into the country, pushing up the exchange rate. In 2011, Brazilian bonds offered some of the highest yields in the world (around 12 per cent at the time). Consequently, Brazilian assets were the fourth-largest foreign holdings by Japanese investors. As a result of Brazil’s new-found status, underlying economic strength and stability, foreign investors had been attracted to Brazil and assets denominated in Brazilian reals.* The currency appreciation problem was made worse by government policy that had created a stable exchange rate against the US dollar, coupled to intervention in the currency market to maintain its value and complex foreign exchange controls. If the currency continued to increase or stayed at the high levels seen in the first half of 2011, local manufacturers would ultimately go out of business. This was due to the fact that foreign producers could undercut locally produced goods of similar quality. Looking at the situation, local firms needed to consider how best to manage this problem. This example is not untypical of the issues that have to be addressed in financial risk management.