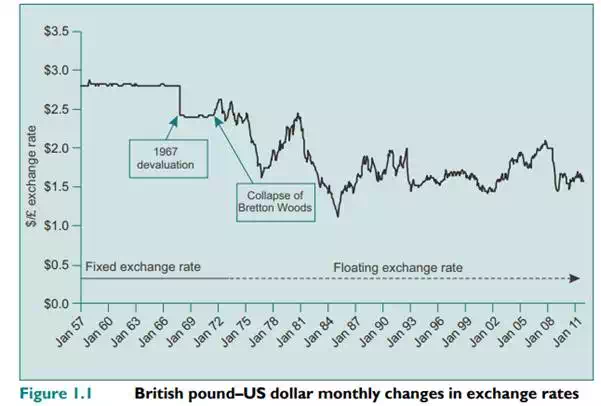

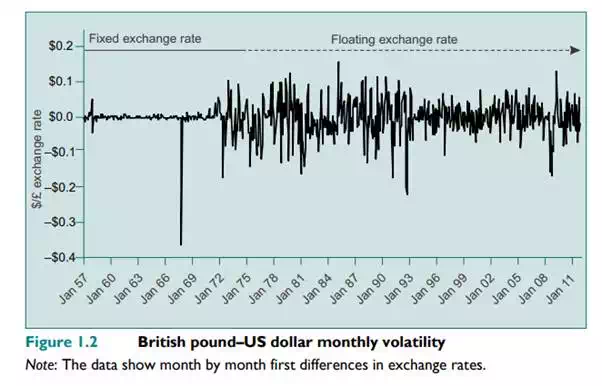

Figure 1.1 and Figure 1.2 show changes in the exchange rate of the British pound against the US dollar. Apart from the occasional currency devaluation, prior to the breakdown of the Bretton Woods Agreement there was relative stability month on month. After the agreement collapsed, increased volatility is clearly evident. Before the collapse of managed exchange rates, exporters and importers could be relatively confident of the prices they would get or have to pay; afterwards, the rules had changed. With a free-floating exchange rate, both exporters and importers had significant currency risk. Exporters sought to protect themselves by pricing in their domestic currency; importers sought to do the same. By accepting foreign currency prices, one or other party stood to suffer a potential loss if the exchange rate moved significantly between the time when the agreement was reached and that when the payment was made.

Currency volatility also affects domestic producers and increases their risks. Medium- to long-term changes in exchange rates affecting a country’s terms of trade can make foreign producers more competitive relative to domestic ones, thus allowing import penetration. The UK suffered such a change in the 1980s when the exploitation of North Sea oil led to a significant increase in the value of the British pound. Many parts of British industry found it very difficult to compete with imports because of the overvaluation of the currency, and suffered long-term damage as a result.

The situation changed again in the late 1980s and the 1990s as the impact of the oil industry on the British pound diminished (partly as a result of the dramatic decline in oil prices) and the pound fell to a more competitive level. But the 1990s saw the British pound continue to show short-term and longer-term swings in its external value. During the first decade of the twenty-first century, the pound continued to enjoy periods of relative undervaluation and overvaluation as sentiment about the prospects for the British economy and interest rates changed from positive to negative and back again. An indication of the problems for exporters and importers is given by Figure 1.3, which shows the trade-weighted index. This has indicated periods of overvaluation for the currency against economic fundamentals matched by other periods of undervaluation. This has created real dilemmas for firms and emphasised the importance of having a sound risk management strategy.

Even if countries manage the exchange rate, this does not always lead to successful outcomes. In 2011, Brazil faced influxes of foreign money as interest rates, set for domestic purposes, made foreign investment particularly attractive. China, by pegging its currency to the US dollar, has maintained an artificially low exchange rate that has greatly benefited its exports and domestic growth, but at the expense of domestic consumption – and the country seems to suffer from chronic inflation. In addition, currency surpluses have had to be recycled, leading to a build-up of dangerous imbalances.

What is clear is that, looking ahead, currencies are likely to experience periods of appreciation and depreciation, and this emphasises the need for organisations to understand and manage these effects.

Comments are closed