The programming of capital projects is shaped by the strategic plan of an organization, which is influenced by market demands and resources constraints. The programming process associated with planning and feasibility studies sets the priorities and timing for initiating various projects to meet the overall objectives of the organizations. However, once this decision is made to initiate a project, market pressure may dictate early and timely completion of the facility.

Among various types of construction, the influence of market pressure on the timing of initiating a facility is most obvious in industrial construction. Demand for an industrial product may be short-lived, and if a company does not hit the market first, there may not be demand for its product later. With intensive competition for national and international markets, the trend of industrial construction moves toward shorter project life cycles, particularly in technology intensive industries.

In order to gain time, some owners are willing to forego thorough planning and feasibility study so as to proceed on a project with inadequate definition of the project scope. Invariably, subsequent changes in project scope will increase construction costs; however, profits derived from earlier facility operation often justify the increase in construction costs. Generally, if the owner can derive reasonable profits from the operation of a completed facility, the project is considered a success even if construction costs far exceed the estimate based on an inadequate scope definition. This attitude may be attributed in large part to the uncertainties inherent in construction projects. It is difficult to argue that profits might be even higher if construction costs could be reduced without increasing the project duration. However, some projects, notably some nuclear power plants, are clearly unsuccessful and abandoned before completion, and their demise must be attributed at least in part to inadequate planning and poor feasibility studies.

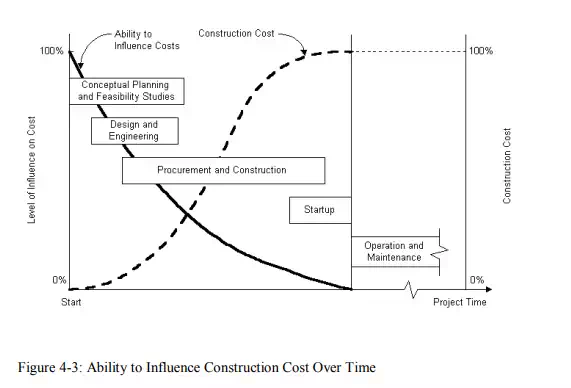

The owner or facility sponsor holds the key to influence the construction costs of a project because any decision made at the beginning stage of a project life cycle has far greater influence than those made at later stages, as shown schematically in Figure 2-3. Moreover, the design and construction decisions will influence the continuing operating costs and, in many cases, the revenues over the facility lifetime. Therefore, an owner should obtain the expertise of professionals to provide adequate planning and feasibility studies. Many owners do not maintain an in-house engineering and construction management capability, and they should consider the establishment of an ongoing relationship with outside consultants in order to respond quickly to requests. Even among those owners who maintain engineering and construction divisions, many treat these divisions as reimbursable, independent organizations. Such an arrangement should not discourage their legitimate use as false economies in reimbursable costs from such divisions can indeed be very costly to the overall organization.

Finally, the initiation and execution of capital projects places demands on the resources of the owner and the professionals and contractors to be engaged by the owner. For very large projects, it may bid up the price of engineering services as well as the costs of materials and equipment and the contract prices of all types. Consequently, such factors should be taken into consideration in determining the timing of a project.