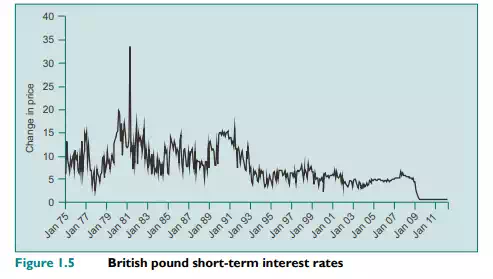

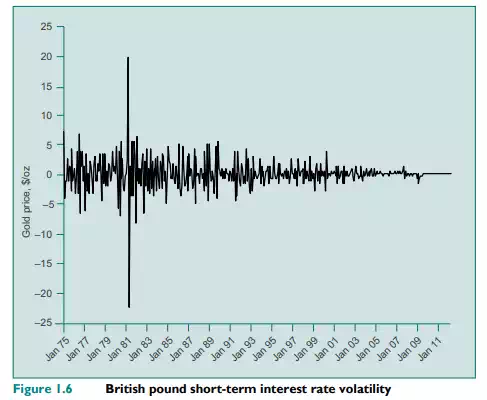

As with currencies, interest rate volatility also increased as a result of the ending of fixed exchange rates. At first, it was thought that countries would be able to pursue divergent economic policies based on domestic criteria, including monetary conditions and interest rates. However, rising inflation, partly caused by currency depreciation, meant that, after some delay, interest rates too became more volatile. This is shown in Figure 1.5, which plots the short-term interest rates in the UK, and Figure 1.6, which plots short-term interest rate volatility.

The increased risk had several effects. The fact that borrowing costs, lending rates, bond prices and yields were unpredictable meant that financial institutions were unwilling to enter into long-term fixed-rate commitments. In response, firms increased hurdle rates on investments, required faster payback and sought better ways to manage the risk.

Comments are closed