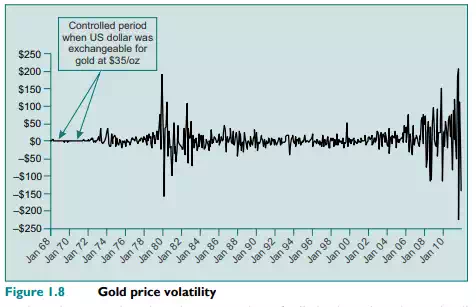

The same increased volatility can be seen in commodity prices. The price of gold, following the US Treasury’s decision to sever the link to the dollar, also changed dramatically, as can be seen in Figure 1.7. The volatility picture in Figure 1.8 is even more dramatic, as the price changes month by month suddenly become very significant.

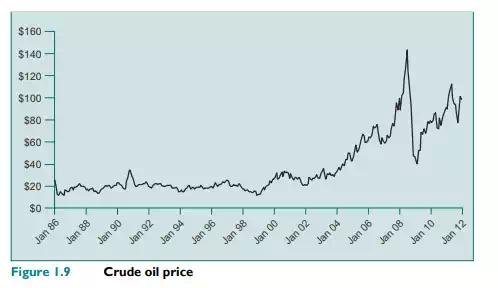

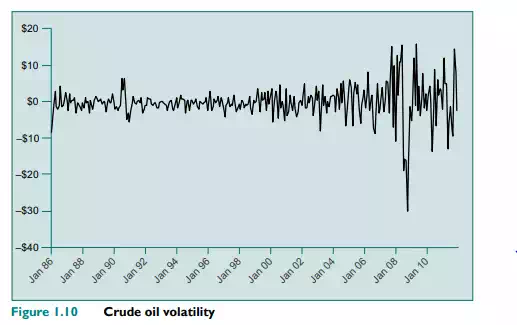

Since the 1970s there have been a number of ‘oil shocks’, when the crude oil price has risen dramatically and subsequently fallen again, as shown in Figure 1.9 and Figure 1.10. The oil price has also been a very volatile series, with periods of extreme price movements. This has made life difficult for oil producers and consumers and increased the demand for risk management to handle this problem. Fluctuations in the price of oil or, more particularly, jet fuel have been a major issue for airlines. They need to show consistent pricing and, in many instances, set prices well ahead of the point where they provide the service. Hence they have sought various means to manage these price risks; these include extensive operational hedging and financial instruments.